Explain Difference Between Llc Owner's Capital Account and Equity

A grant of a profits interest in a partnership can be taxed at the time of grant or at the time of vesting if subject. When a company has negative owners equity and the owner takes draws from the company those draws may be taxable as capital gains on the owners tax return.

Owner S Equity What It Is And How To Calculate It Bench Accounting

The current account is the difference between a countrys savings and investments.

. It refers to the individual balances in the equity section of the balance sheet. Owner Equity parent account Owner Draws sub account of owner equity Owner Investment sub account of owner equity View solution in original post. In simple terms owners equity is defined as the amount of money invested by the owner in the business minus any money taken out by the owner of the business.

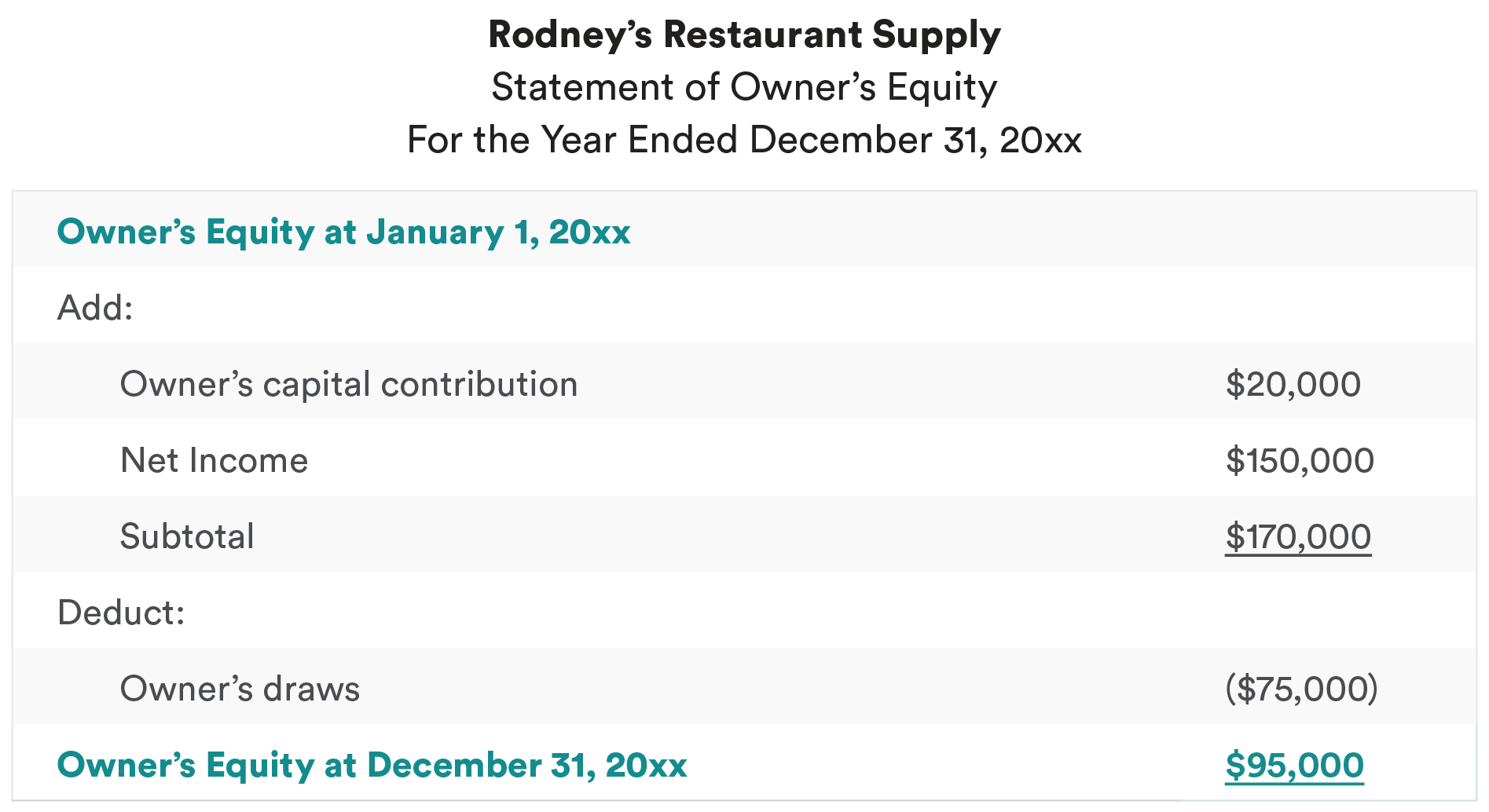

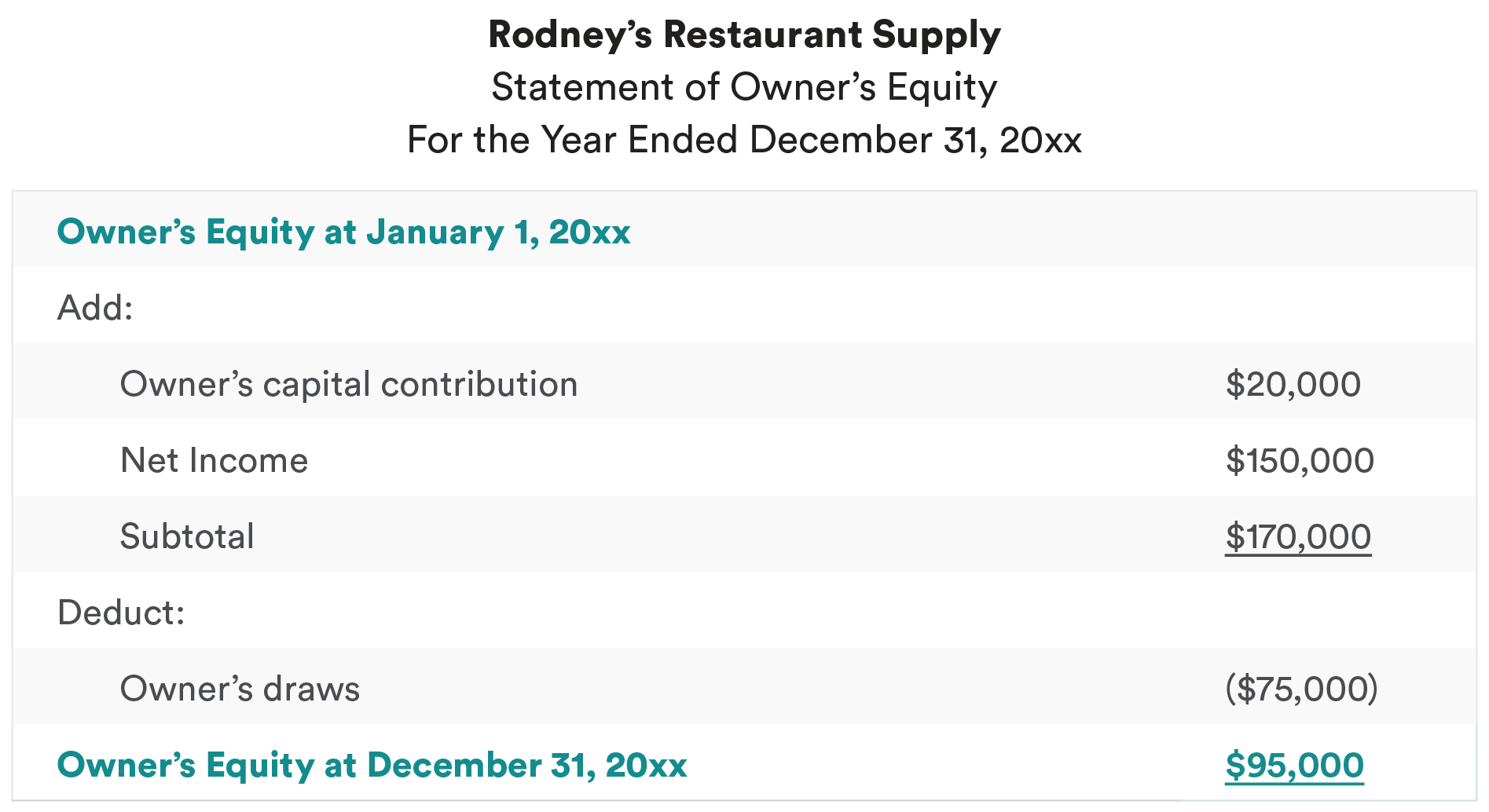

The basic formula for value is beginning balance plus contributed capital plus earnings from the current accounting period less any withdrawals. This is understandable as many people view the two types of business entities as being functional equivalents of one another. Then Owners Capital is 20m Assets of 50m fewer Liabilities of 30m as at 31 st December 2018.

Capex refer to the purchase of fixed assets. Business owners might use a draw for compensation versus paying themselves a salary. Today I answered a LinkedIn question about forming an LLC where some members have no ownership of the LLC but receive a share of cash resulting from the businesss profits their economic interestThe question and answer are reproduced in somewhat edited form below.

Equity Shares are the main source of raising the funds for the firm. Total Assets Liabilities Shareholder Equity read more of 50m and total liabilities of 30m as at 31 st December 2018. In a multi-member or partnership model each member contributes and owns a specific percentage of the LLC along.

Owned capital can be in the form of equity whereas borrowed capital refers to the companys owed funds or say debt. In other words this account shows the how much of the company assets are owned by the owners instead of creditors. Since I first wrote this post LinkedIn has shut down its QA feature so you no longer.

Owners Equity Assets Liabilities. It can be interpreted from above that assets of 20m are funded by the Owners Shareholders of the business. Owners draws are usually taken from your owners equity account.

However equity is different to liabilities because liabilities represent an obligation that must be met by the firm. Equity and loans can serve the same purpose by funding an investment or project. When you put money in the business you also use an equity account.

Owner draw is an equity type account used when you take funds from the business. A Capital Account is a term used in partnership and in limited liability company business formats. A capital expenditure is a term the IRS uses to classify certain business purchases.

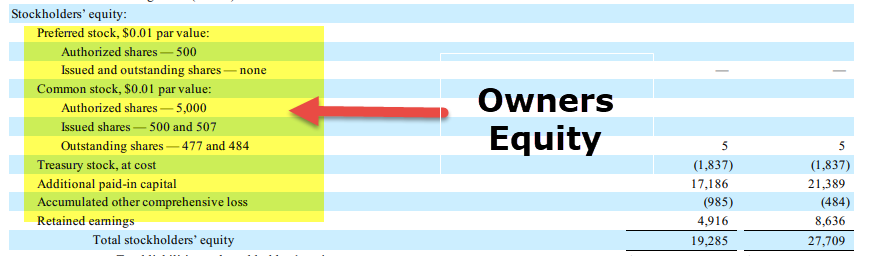

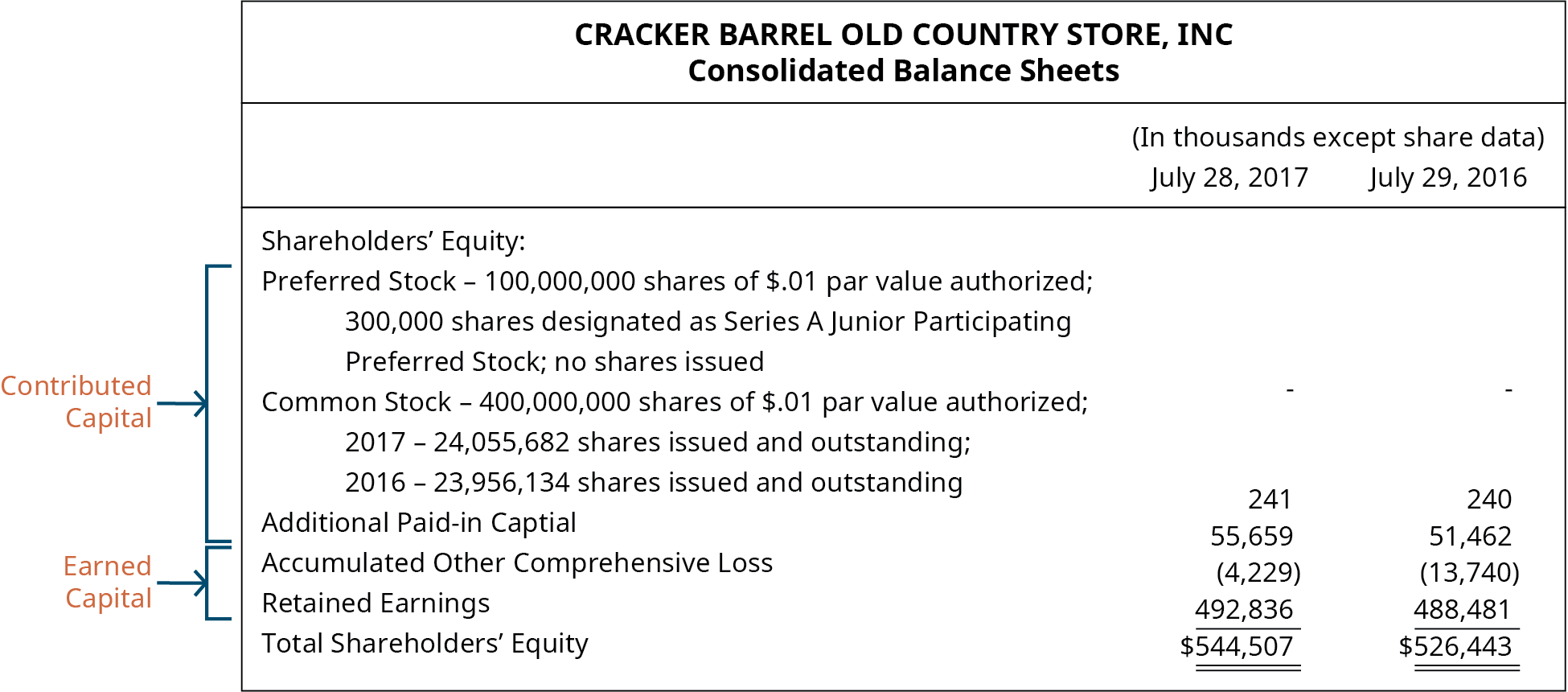

A companys equity typically refers to the ownership of a public company. Typically the owners capital account is only used for sole proprietorships. Assets include cash inventory furniture equipment and real estate owned.

Shareholders equity is the difference between a company. For that reason business owners should monitor their capital accounts and try not to take money from the company unless their capital account has a positive balance. A capital interest on the other hand is an interest in the assets of the partnership.

On the contrary debt is the sum of money borrowed by the company from bank or external parties that required to be repaid after certain years along with interest. The equity or capital in a firm is equal to the difference between the value of its assets and liabilities. Upon sale or liquidation of the partnership assets the holder of a capital interest would share in such distribution of assets or proceeds.

Furthermore capital is used in calculation when deriving the value of equity as shareholders equity is the sum total of financial capital contributed by the owners and the retained earnings in the balance sheet. Difference Between Equity Shares vs Preference Shares. Updated July 8 2020.

These accounts track the contributions of the initial members to the LLCs capital and adjustments are made for additional contributions. The rule of thumb is that any asset your company purchases that will last for more than one year is considered a capital. With the flexibility offered by the Virginia LLC Act it is not unusual for LLC owners to incorporate many corporate-like.

The similarity between equity and capital is that they both represent interest that owners hold in a business whether it is funds shares or assets. Business owners can withdraw profits earned by the company. A countrys capital account records the net change of assets and liabilities during a certain period of time.

Ways to increase the balance of a capital account include. The only difference between owners equity and shareholders equity is whether the business is tightly held Owners or widely held Shareholders. Equity refers to the stock indicating the ownership interest in the company.

It is a form of partial or part Ownership in the company in which shareholders bear the highest business riskAll equity shareholders are collectively owner of the company and they have the authority to control the affairs of the business. Unlike other business purchases a capital expenditure is a bit of a longer term investment. Owners Capital also called owners equity is the equity account that shows the owners stake in the business.

Expressed in another way. Capital accounts LLC are individual accounts of each persons investment in an LLC. Owners equity is made up of different funds including money youve invested into your business.

The Basic Accounting Equation. A single-member LLC has a sole ownership and controls 100 percent of the funds in the capital account. In other words the value of a businesss assets is equal to what the business owes to others liabilities plus what the owners own owners equity.

Small business owners and entrepreneurs often use and confuse LLC and corporate terminology and concepts. A companys equity and shareholder equity are not the same thing. So your chart of accounts could look like this.

Stockholders equity or owners equity equals the value of company assets minus company liabilities. The basic accounting equation is Assets Liabilities Owners Equity. Ownership percentages as it relates to capital accounts is most commonly a concern for the multi-member LLC business or partnership model.

Owner S Equity Definition Formula Examples Calculations

Balance Sheet Long Term Liabilities Accountingcoach

Compare And Contrast Owners Equity Versus Retained Earnings Principles Of Accounting Volume 1 Financial Accounting

No comments for "Explain Difference Between Llc Owner's Capital Account and Equity"

Post a Comment